Last Updated on November 23, 2021 by Carlo Navarro

It may seem counterintuitive, but the media may be any wealth advisor’s biggest competitor. No, CNBC isn’t going to steal your clients per se, but the media can significantly edge in on clients’ attention spans, leaving little room for anything else (like sound advice, for example). The media has the power to spur panic, discord, and confusion, prompting many clients to take rushed or even reckless actions when it comes to their finances. In that regard, advisors are competing with the media 24/7 for clients’ attention and trust.

Without the right tools to combat this problem, many advisors are left experiencing the worst — panicked phone calls during market volatility.

How CNBC — and Other Media — Make Your Clients Edgy

The media never leads with calm and measured information but instead relies upon attention-grabbing headlines, disruption, and chaos. Worse yet, it delivers this information in catchy soundbites that burrow into clients ears, only to be replaced by the next frenzy-inducing jingle of information.

We call this the “CNBC Effect” — the idea that breaking news, ticker streams, and contradictory information flood in and overwhelm people at a steady cadence.

The onslaught of noise only leads to confusion and has the power to make any reasonable person edgy.

This aim to agitate is impactful and can have a negative effect on your business — and on your clients’ long-term goals. Incomplete information makes us react incompletely, and our incomplete knowledge just adds to our stress.

Understanding the “More Information” Fallacy

Conventional wisdom would have us believe that more information only drives more fear. Most people and most advisors think that having more information about our money makes us uneasy. As a result of knowing “too much”, people become restless and make changes just to “do something” in a counterproductive effort toward self-preservation. There is some truth here, especially in bumpy markets.

That said, it’s important to acknowledge that information doesn’t cause problems; rather, it’s the high volume of fragmented data and irrelevant noise that drives us mad.

It Turns Out Ignoring or Shutting Out the Media Isn’t Possible

Advisors have rightly responded with the advice “don’t listen to the noise.” Unfortunately many also say, “just look at our annual or quarterly reports and ignore everything in between.” While some may argue that infrequent contact with our long-term money is ideal in a perfect world, it ignores one key fact: we’re human. Time passes and things happen between annual meetings and quarterly reports that create questions and give us pause. We live in a world where information fragments flow at a frightening rate and “ignoring it” till the next scheduled pit stop on the information rationing highway just adds to our stress and makes us MORE likely to think irrationally.

To be fair, advisors haven’t had tools to help their clients filter the noise and focus on what’s important. Their comprehensive and often excellent reports involve lots of manual work to prepare (and sometimes to read and understand). So even quarterly reports are often more than many advisors can afford to do for their clients.

Enhance Your Client-Relationships with Blueleaf.

Get better reporting, billing & invoicing, trading and rebalancing, client engagement, business intelligence and financial data processing for wealth managers.

Can You Help Your Clients Feel Peaceful About Their Money?

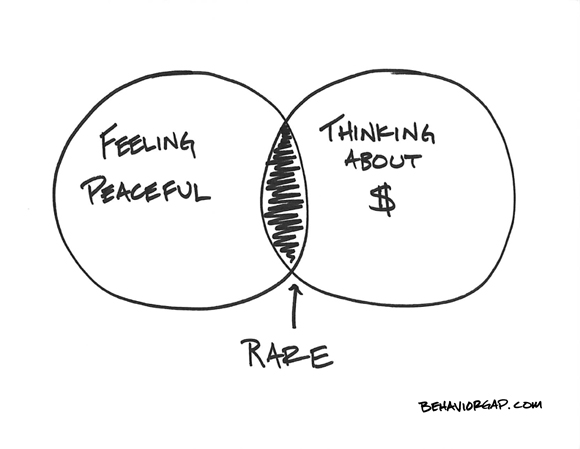

My friend Carl Richards recently posted this sketch; I think it captures something critical to the work of financial advisors, and central to the reasons we founded Blueleaf.

Feeling peaceful when thinking about money shouldn’t be rare.

Carl wrote:

In my conversations about money, the most common desire people express is a simple desire for peace. We all just seem to want to get out from under the constant stress that so often comes whenever we talk or think about money. Money is insanely emotional because of what it often represents. When we talk about money we are talking about our closest-held dreams and goals.

…While it is often a rare event to be thinking about money while at the same time feeling peace, let’s all hope we can make decisions so that it happens more often.

This sketch was shared courtesy of Nancy Robinson who is doing some really great things around financial literacy at fariseducation.com.

The Evidence Says ‘Yes, Feeling in Control is Possible’

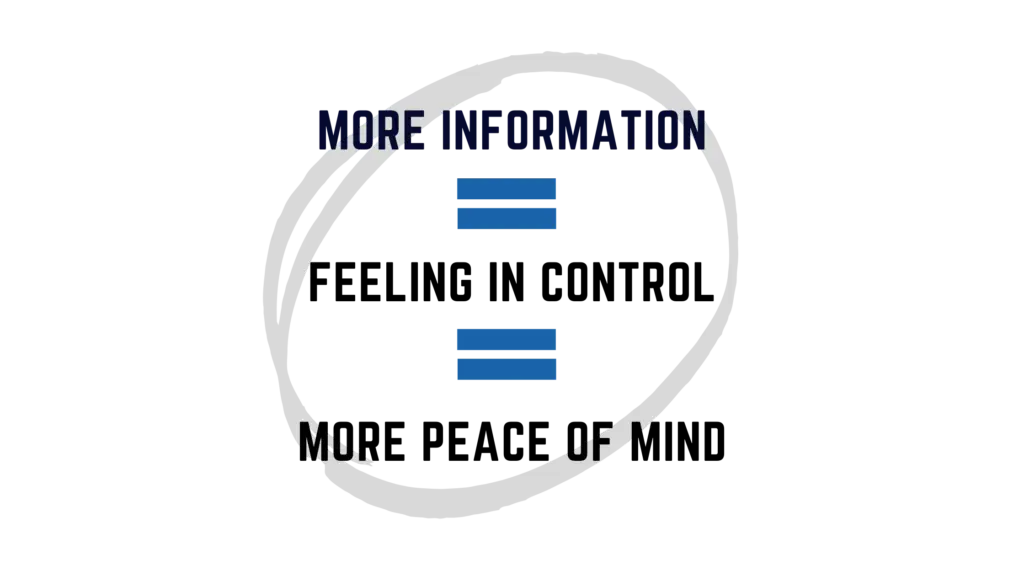

At Blueleaf, we’ve learned something fascinating and to some, counterintuitive. When provided with clear, simple, consolidated information about your money on a regular basis, you feel better, calmer and more in control. That’s right:

But it has to be the right kind of information.

What is the “right kind” of information? It’s the kind that cuts through the noise with client-centric value. It slices through media mayhem and delivers on clear communication that persuades clients to stay the course and follow your advice. Just how do you do that?

Stay tuned.

Check out these related articles:

Also published on Medium.