Last Updated on February 10, 2022 by Connor Prendergast

The Problem with Rebalancing

You’d think by now we’d be further ahead. With all our technical advancement, why is rebalancing still missing the mark? We’re ten years into the “robo revolution” and this critical technology is still leaving most financial advisors unautomated, unable to manage at the household level, and still making manual entries and spreadsheets. Advisors deserve better than that.

Let’s review the innovations in wealth management over the past ten years. Robos have been going strong since 2011 and have brought the concept of automated investing to everyday consumers. Automation has made it possible for advisors to compete against them. FAs have evolved their business models to offer a more holistic approach.

Meanwhile, wealth managers are still using spreadsheets to calculate rebalancing. Why? The few moderately effective rebalancers on the market are expensive. Free tools don’t have the functionality to justify the time investment necessary to use them. Any automation that does exist is available mostly for single accounts. How can you manage holistically with that restriction?

Free Tools are Holding Us Back

Has your custodian provided you a “free” rebalancing tool? Chances are, it doesn’t do the job you need it to do. Many FAs are using only some of the functions, like automated drift tracking. That’s a nice feature to have, but free rebalancers can only track one account at a time. That doesn’t help when you’re trying to holistically manage a client household.

Another issue with free tools is that they’re provided by your custodian, so they only track the accounts you manage through that custodian.

There’s no way to pull in held away assets or other accounts you might manage through a competitor. Client households contain outside investments, like 401(k)s and self-directed investments. How do you account for those?

It’s no wonder that wealth managers turn to spreadsheets when it comes time to rebalance. Even with some automation, most advisors don’t trust the output of their free tool enough to simply “take it on faith.” The time investment required to “get it right” is holding them back from expanding their client base. That’s not a benefit. It’s a burden.

Expensive Rebalancers Don’t Do the Whole Job

One might assume that paying for an expensive rebalancing tool would solve all these problems. It doesn’t. Aside from the additional cost, most rebalancers don’t do the whole job. Even “all-in-one” tools, which are more expensive, can’t bring in held-away assets. Some are multi-account capable, but they’re clunky and generally difficult to get full value.

The underlying problem with both paid and free rebalancing tools is that there’s a disconnect between how advisors want to manage assets and the output of rebalancers. Modern FAs think and manage holistically. Rebalancing is centered on individual managed accounts. Tools with multi-account capability add some value but they still presume account control. It’s not enough.

The Growing Disconnect Between Principle & Action

The bottom line for advisors is that there is a gaping disconnect between how advisors think about advising clients and the actual execution. Advisors aim to provide holistic advice yet asset management continues to center around individual managed accounts.

As a result of their limits, most current rebalancing tools can only ever be a partial solution for financial advisors.

In most cases, the amount of work necessary to use them doesn’t justify integrating them into a firm’s technology stack. This may explain why still today most advisory firms do not have a rebalancing solution. Advisors need a rebalancer that can bring in managed accounts, held-away accounts, and multiple custodians.

Another issue with existing rebalancing platforms is that FAs are either getting a single, limited tool or an expensive all-in-one where they have no choice but to use the entire suite. That involves switching over performance reporting, risk management, aggregation functions (if any), and analytics. That’s a lot of work for a tool that doesn’t do what you want it to.

The ideal scenario for wealth managers would be to have a rebalancer that can be bought as a stand-alone tool or as part of a technology suite. It needs to be transparent enough so that FAs trust the output and sophisticated enough to handle complex client households. That’s the only way that advisors can manage client households holistically.

This is all part of a larger issue in wealth management. Advisors must connect and align the advice they want to give with the way in which they manage assets. This will require them to make use of technology and automation in a way that accomplishes their business goals. The solution is not simply to “do it faster” but to “do it at all.”

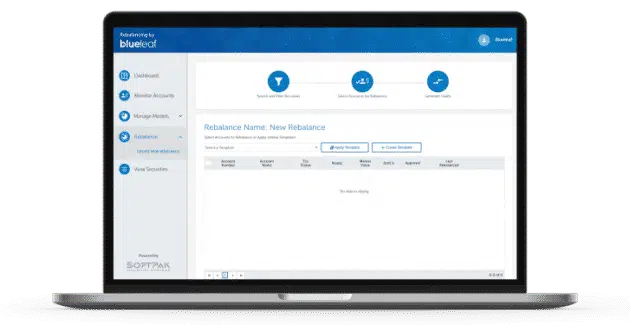

Sophistication without the Complexity

A streamlined interface on top of a market-leading engine, leaving you with a beautifully-designed rebalancing tool that will make your firm easier to operate.