Last Updated on April 19, 2022 by Connor Prendergast

In an age where automation can be applied to almost any administrative function, a manual process mostly done by hand in excel — like rebalancing — simply doesn’t fit. We covered this in our “rebalancing sucks” article a few weeks ago.

Visualize the rebalancing process for a moment. Advisors are required to initiate all the action. They have to calculate the movement of each security in every account on an Excel spreadsheet, then measure it against a target allocation model.

That’s a whole lot of work. Even with drift tracking, the actual rebalancing is still a labor-intensive process, causing most advisors to only do it once or twice a year. There’s reasonable justification for doing it that way, but competitors offer more than that.

Take this one step further. The process we just described is for a single account. Upgrade that to the household level, with multiple accounts, and the workload increases exponentially. The time involved becomes all-consuming. That’s the reality we’re dealing with.

The Rebalancing / Advisor Disconnect

Financial advisors don’t spend their time discussing single accounts with clients. The modern approach to wealth management is to view client households holistically. That’s the way we think and how we want our clients to view their financial picture.

Can you see the disconnect? Advisors preach a holistic approach and encourage clients to view wealth building in the same manner. Current rebalancers target individual securities and can’t bring in held-away accounts. As the song says, “One of these things is not like the other.”

This is a systemic problem for financial advisors. The way they connect to and advise clients is not in line with the way they manage assets. It can’t be. The tools and technology needed to manage holistically are just not there. That needs to change.

With rebalancing, we can’t just simply “speed up” the current processes available to advisors. Automating the current process doesn’t solve the problem. What we’re talking about here can’t be done at all, with currently available tools.

A Rebalancing Vision for the Future

Science fiction sometimes becomes science fact. The concept of automation set off alarm bells in the seventies. Today, machine learning is a reality that powers hundreds of business applications. Simple automation is even more prevalent. We use it frequently in financial services.

Imagine what life would be like if rebalancing included all client accounts automatically. As Morpheus said in the Matrix, “Free Your Mind.” Travel down this thought path a little further and you can easily see automated, drift-based rebalancing happening as often as needed. Set the criteria, receive the trade recommendation, push the button to execute. Once per year for some clients, many times for others with no difference in effort but a big improvement in client outcome.

Incorporating Held-Away Accounts into Rebalancing

Holistic wealth management is dependent upon being able to see the whole client picture. That includes held-away accounts, which should be part of the rebalancing process.

Advisors often adjust managed accounts to offset poor performance in held-away accounts.

The rebalancer of the future will include a way for clients to receive recommendations to make changes to their held-away assets. These “friendly suggestions” would be in line with the financial advisor’s portfolio management strategy. It would support the client’s action.

Value Delivered Must Be Value Understood

As the question goes, “if a tree falls in the forest but no one hears it, did it make a sound?” For an advisory business the answer is clear. Value needs to be delivered AND perceived by clients to be real. This is another area where most current rebalancers fall short: reporting on the value created.

Not only must the application do the work of rebalancing, it must also report on that work in a client-friendly way that clarifies the work done and the value created. Think “Turbo Tax simple.” They’ve mastered the art of making simple recommendations that their users just accept because they make sense to them. To create real value rebalancing must be explained in a straightforward way.

Stay tuned. In the coming weeks, we’ll be introducing a solution that makes truly holistic wealth management possible through rebalancing.

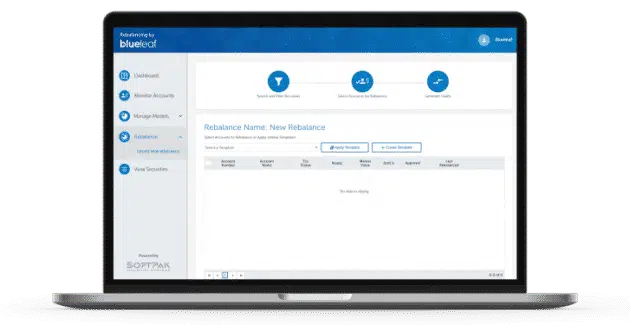

Sophistication without the Complexity

A streamlined interface on top of a market-leading engine, leaving you with a beautifully-designed rebalancing tool that will make your firm easier to operate.