Last Updated on July 20, 2020 by John Prendergast

Most advisors hear “annual growth strategy” and think marketing ads, networking events, social media, client referrals, and other forms of actively pursuing new prospects.

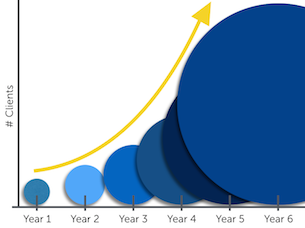

But one midsize advisor found a not-so-typical marketing strategy that’s helping him maintain 50+% annual growth:

Routine engagement with his current clients. And frequently.

Who would’ve thought increasing the contact you have with current clients would drastically effect the number of new clients flocking to your firm?

Who would’ve thought increasing the contact you have with current clients would drastically effect the number of new clients flocking to your firm?

This guy did.

A long-time Blueleaf user attributes much of his success to reaching out to clients at least 150-200 times per year. (Yes, that frequently.) This volume translates into a minimum of 12.5 touches per month. Clearly, he’s got client engagement down to a science. Given that his midsize firm is growing at this impressive rate, we know he’s on to something.

Keeping clients happy is smart business.

It’s 5 times easier (and less expensive) for an advisor to keep an existing client than to attract a new one. Happy clients who feel valued and respected are also more likely to talk about your business and refer people they know. He’s found that more client contact = more new clients.

It all makes logistical sense, and you’ve heard about this kind of “client engagement” before, but you have a few big questions. Well, we got the answers.

12.5 touches per month? What do you say?

A variety of things. And that’s why it works. In his words…

POLLS

First, it’s important to know we regularly poll clients and our blog followers using Survey Monkey. This helps us know better how our clients are feeling, what they are worried about, and how we can better serve them. If you don’t ask, you’re just guessing.

Among other things, we use this information to deliver helpful, highly relevant content.

BLOGGING

We write helpful blog content at least twice each month, and we average about 4.

The best way to define “helpful” content is to specifically poll clients (again, use Survey Monkey or similar). Again, if you don’t ask, you’re just guessing.

A great question to explore this is, “If you use the internet to search for answers to financial questions, what questions specifically are you trying to solve?” This is great because if your best clients provide feedback you’ll know exactly what type of information you should be publishing in order for other similar potential clients to find. Long tail questions like, “How to choose the best pension option from Boeing?” will be narrowly searched, but those searching for it are great potential clients. They are at a point of immediate need, and a point where serious money is certainly in motion.

VIRTUAL CHECK-IN’s

We do “virtual” meetings with clients every 6 months. We use Blueleaf as the screen sharing component so clients can easily see the two things they always want to know:

1) What do I have?; and 2) How am I doing?

Virtual meetings + Blueleaf = I’m able to (and do) work with clients from anywhere.

GOOD OL’ NEWSLETTER

We do a short (just two articles and two pages) newsletter for all clients, monthly. This was professionally designed and branded, and includes the photo of each advisor so every client “sees” their specific advisor on a monthly basis.

How does he manage to reach all of his clients so frequently without becoming annoying?

Well, remember that a touch can be delivered in various ways: in person, via email, phone, social media, or traditional mail. By mixing push methods and pull methods (like email and blogging), clients will consume what they like and happily skip the rest. This kind of frequent contact with thoughtfully shaped messages that reflect clients’ individual interests powerfully reminds clients of your value even if some of the content is “ignored” by some clients.

The more clients feel you’re delivering value to them, the happier they’ll be. The happier your clients, the more likely they are to give referrals—which of course are essential to growing your business. Also, if you’re not proactively reaching out to your clients, be aware that other advisors are. It’s naïve to think that if they’re in your book, they’re your client forever. Once you’ve invested in a client relationship, you have to protect your investment if you want to prosper in the long run.

How does he manage to reach all of his clients so frequently without adding 40 hrs/week of additional work?

Of course the only way to deliver this volume of client touches is via automation. Four of his 12 monthly emails are automated by his Blueleaf client engagement tool, for example. To get general help with automated emails,check out Page 7 of this whitepaper (and you’ll find out who the advisor is!).

This article includes excerpts from the free whitepaper downloads, How To Generate More Referrals Automatically and The Ultimate Lesson for Effective Client Meetings. Download copies to get access to “How To” help for implementing a content strategy in your advisory business today.