Last Updated on July 20, 2020 by John Prendergast

I’m a financial planner.

I’m also a member of a group that I do not like — I’m a widow.

We widows are one of the fastest-growing segments of the U.S. population. Indeed, half of all married women experience widowhood before age 60. Our ranks are growing at the rate of nearly 1 million a year, according to the Census Bureau.

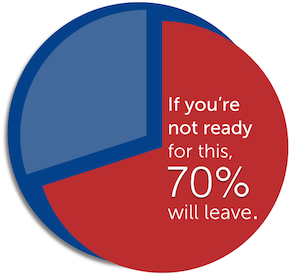

It’s reported that 70% of widows change advisors after their spouse dies. Widows have said their advisors didn’t “get them”… didn’t understand the grief process and where they were at in their journey as a widow.

It’s reported that 70% of widows change advisors after their spouse dies. Widows have said their advisors didn’t “get them”… didn’t understand the grief process and where they were at in their journey as a widow.

“Mostly my advisor just focused on my husband,” I’ve been told by new widows. “Those quarterly investment reports never made much sense to me. I didn’t care if I was beating the market or not. I just wanted to know I had enough. And when I cried in his office, he really didn’t know what to do with me. I just wasn’t comfortable working with him anymore. So I left.”

It’s a huge problem.

You can’t predict the death of a client. But insuring your business with the knowledge to work well with a widow IS something you can do.

As a CFP® and widow, I’ve had direct experience on both sides of the table. I’ve spent the past 7 years using this insight to help other financial advisors serve widowed clients better . . . and encourage relationships that “stick.” To get started, here are:

6 Insider Tips for Working with Widows

1. Help her feel safe and secure. Beating the markets is the last thing a new widow cares about. She wants to know, “Am I going to be okay financially?” “Can I still help my grandchildren with their college expenses?” “Do I have to go back to work . . . or look for a higher paying job?” Her highest priority is understanding her current financial position and maintaining a good lifestyle. I’ve worked with multi-millionaire widows who were afraid they would be bag ladies.

2. Encourage your widowed client to take time with non-urgent decisions. A new widow doesn’t need to instantly rebalance her portfolio when she’s in early grief. That will come later, when she’s in the second stage of widowhood—growth.

3. Be her “thinking partner.” Drop the fancy charts and financial jargon. Talk to your widowed client in regular language about her situation, including her needs and goals. A new widow’s brain freeze is very real. Her attention span may be short, memory weak, and decision making downright difficult. Find the right time to talk about ideas when she’s not feeling overwhelmed and numb. Even very smart women with advanced academic degrees may have problems reading their brokerage statement or balancing a checkbook. Provide a written summary of your meetings, noting a few action items to be done NOW, SOON, and LATER. This is especially important during a widow’s stressful transition period when she may be highly forgetful.

4. Offer to help with activities that seem overwhelming. These will vary per client. You may choose to accompany your newly widowed clients on trips to their attorney’s office to settle the estate, if that’s helpful. Another idea is to think about starting a list of recommended handymen. A little support goes a long way here.

5. Avoid common mistakes in conversation. Don’t use clichés such as “At least you had a lot of good years together” or “Time heals all wounds.” Encourage her to share memories of her husband. Use her husband’s name. (We widows don’t want the world to forget our spouse.) It’s alright if she cries, because these will be healing tears.

[Perhaps since my husband was a pastor, some folks thought they were being nice to tell me, “God needed another angel in heaven.” (Wrong! I needed that angel beside me and not in heaven.) Or they said, “I know exactly how you feel.” (They couldn’t possibly know.) A better comment for you to make is “I can’t imagine what you’re going through now. Would you like to tell me about it?”]

6. Show compassion and care. In addition to your empathetic support, encourage widowed clients to participate in grief classes or support groups offered by local hospices, congregations or online resources. Many women enjoy and find hope reading other widows’ stories, through online chat sites and books written by widows.

In a future blog we’ll discuss the 3 Stages Of Widowhood, including suggested actions for you to take during these phases. In another blog we’ll talk about Impactful Empathy—What to Say and When to Say it to Widows. If you’re interested I’ll also share a Toolkit For Advisors.

What’s your experience in working effectively with widows? Please share a tip that has been especially successful for your practice.