Last Updated on July 20, 2020 by John Prendergast

The Baby Boomer generation is happy with their financial advisors; they trust us and value our work. They grade their “service satisfaction” in the B+/A- neighborhood. Not shabby. But this generation of investors isn’t growing.

The Baby Boomer generation is happy with their financial advisors; they trust us and value our work. They grade their “service satisfaction” in the B+/A- neighborhood. Not shabby. But this generation of investors isn’t growing.

There’s a huge new pool of prospects we’re about to fish in – and it’s a pool that’s growing with each passing minute. But these investors are not as happy with us. Yet. And they won’t trust us until we deliver what they’re asking for.

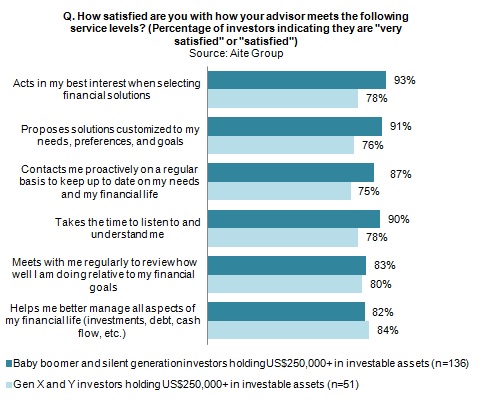

A recent article from Sophie Schmitt illustrates how the satisfaction of a client with their financial advisor’s service differs between Baby Boomer and Gen X/Y investors.

In 5 of the 6 categories, the Gen X/Y investor is notably LESS satisfied with their advisor than the Baby Boomer investor.

Why is that? A traditional opinion would attribute those statistics to the experience and perspective of both the investor and advisor (since Baby Boomer investors naturally gravitate toward advisors of a similar age). At a glance I might agree, but as an advisor serving both Baby Boomer and Gen X/Y investors, I think we’re missing the underlying issue.

The issue has more to do with the personality of the investor than a blanket approach to client service by the advisor. I believe it boils down to Trust vs. Transparency. To fully comprehend the issue, we must first understand each investor.

We’ve been trusted by default…

“We” Baby Boomers grew up at a time when hard work, sacrifice, and commitment meant something. Trust was a key component for other key areas of our lives. We developed long-term relationships with our mechanic, banker and financial advisor while trusting that they would take care of us. Those relationships built on trust were not chosen, but more of a necessity because all of our time was spent on our career, goals, and family.

Due to that general (and maybe stereotypical) personality, we perceive the level of service provided by our financial advisor to be better than in reality. That’s because we trust our advisors, by default, until they give us reason to think otherwise.

But this pool is different

“Our” parents put an enormous amount of faith in the industrial system, their career, and their employers. Our parents have pensions that are still intact and social security checks that are equal or close to what was promised. Over the last 20 years, those fundamental values have been shaken when we lost those components of our future financial stability. Now our personality is more similar to those from the Show Me State of Missouri. Our default opinion has now become “I don’t believe it until you show me or until I see it for myself”. The cornerstone of our key relationships is now based on Transparency because we carry a chip on our shoulder resulting from a lack of fundamental trust.

No longer do we buy vacuum cleaners from a stranger on our doorstep, and we surely don’t give a financial advisor our trust just because he has been around for a long time or says we can trust him. Those old tactics from the 80’s and 90’s don’t put us at ease when an advisor can rattle off an impressive resume or use big words like arbitrage or Modern Portfolio Theory.

We value transparency over trust. We want to see where our money is and what it’s doing at any given time. Advisors have been hesitant about providing that level transparency for fear of losing clients to the Do-It-Yourself (DIY) mentality. That is misinterpreted fear. We as Gen X/Y investors don’t have the time to manage our money and therefore don’t mind paying someone else to keep up with it on a daily basis. All we’re asking for is simple, yet regular access and connection to what we own.

Wake up, smell the coffee, and move the needle

I know that I might have gone off on a generational tangent, but my experience in working with both Baby Boomer and Gen X/Y investors tells me that their unique experiences and personality is driving their perspective.

Neither perspective is right or wrong, investors are simply begging advisors to listen to them and be understood.

It’s our job to read in between the lines. To understand that our clients are unique and that their view on life, relationships, and money was created by their personal experiences. If financial advice is truly personal, then advisors must understand each client’s unique personality before applying the complex strategies and solutions that will accomplish the client’s goals.

With all the incredible technology at our fingertips today, we as advisors have the ability to give each of our clients what they want and need.

We CAN connect Baby Boomer investors to what they own and simply the conversations so their trust can be reaffirmed. Simplified reports and statements help these investors understand how their money is growing and being protected by their advisor. Without that, Baby Boomer investors rely more heavily on blind trust because they cannot see the value their advisor brings to the table each day.

We CAN unite Gen X/Y investors with their money showing them how easy it is to access online from their computer through an on-demand, well-designed client portal. A computer to these generations not only means the traditional desktop, but also includes laptops, tablets, and smartphones. Online access means constant access. This generation of investors will often use technology to be more efficient with current tasks, but notoriously fills that saved time with additional activity. Instead of attempting to change that hardwired mentality, advisors need to find ways to use technology to more efficiently deliver the message to these investors. The fundamental message each investor should know is what they own, where it is, and why they own it. (Tweet this.)

With that generational understanding in mind, the results of Schmitt’s article make much more sense. Investors are asking for improved client engagement.

Baby Boomer investors are screaming, “We want to trust our advisor through good service and simple conversations” while the Gen X/Y investors are begging for help in efficiently managing all aspects of their financial life, and need to see it.

How I’m Tackling This In My Business

So, I always remind my clients that a Rule of Thumb is a great starting point, but was never designed to be implemented as a stand-alone solution without applying the current situation and environment. The same approach has worked well as I try to connect my clients to what they own while having simple, productive conversations about how to manage it.

I give my clients access to custom reports, online, any time they want to see them.

Starting with the big picture is crucial, so I use an account aggregation and automated reporting tool (Blueleaf.com) to connect my clients to everything they own. This connection process is my technological “Rule of Thumb”. Once clients can see all of their accounts and what’s inside them in one consolidated dashboard, only then can we have those simple, productive conversations about how to allocate, rebalance or adjust each account according to their personal risk tolerance and the current market environment. They love it. Applying that personal filter is where I take into account each client’s background, experiences and personality toward money. You can try it free for 30 days here.

One of my clients who is an Estate Planning Attorney likened this process to his own job. He told me that getting everything set up (i.e. a will, trust or estate plan) and organized is only half the battle. The other half is managing that original plan to ensure that everything falls into place according to its unique design while adjusting to the client’s current set of circumstances.

Connect. Converse. Adjust. Repeat.

Brad Raines

@ModernAdvisor

Phone: 800.775.8124

Email: brad@appliedcapital.com

Related: NextGen Investors Demand Advisors Use a Client Portal

Photo credit: pennstatenews, Flickr