Last Updated on July 20, 2020 by John Prendergast

Blueleaf has a team dedicated to customer success, creatively called the Customer Success team. As part of what we do, we look for customers that are crushing their business objectives [by using Blueleaf] so we can teach other advisors how to do it too.

Our Customer Success team talks with these advisors often to find out what they are doing that is working so well.

“We’ve uncovered a pattern with the highest growth Blueleaf advisors. This pattern is so consistent that I thought we had to document it and let our advisor community know ASAP.”

Justin Shepard, Blueleaf Customer Success

What is the pattern that we see? It’s simple. Superstar advisors gather tons of client information and feed a value added version back to their clients — frequently. Really frequently. This gather and feedback loop always begins for these rockstars before their first meeting. These advisors use soft words like helpful, organization, transparency, trust, and differentiation to describe why but the business results are hardcore.

1. Why Helping People Get Organized is a Proven Growth Winner

Mint.com grew to 17 million users with “getting organized” as their primary message. The gather and feedback loop was the core process that helped users feel organized. Sign up with Mint and POW within minutes you can see all your accounts. A few minutes later you’re getting an email with a totally transparent view of ALL your money based on your own data. Powerful stuff.

Personal Capital (an investment version of Mint.com) does the same thing but with more of an investment focus. Personal Capital supports over 700,000 customers. This creates an important connection with users who come to view these services as the center of their financial universe. Once that happens, users look to these services to help them in other ways. For Mint.com, it might be for a mortgage or credit card, for Personal Capital it’s investment services.

The good news is that advisors can deliver this kind of powerful experience to their own clients and prospects leveraging their own gather and feedback loop by gathering comprehensive information, consolidating it and feeding it back to clients in helpful ways. In doing so, all your clients’ financial data is centered around you and your firm. You become a single stop for their financial information but with a better experience because you are in the mix guiding them.

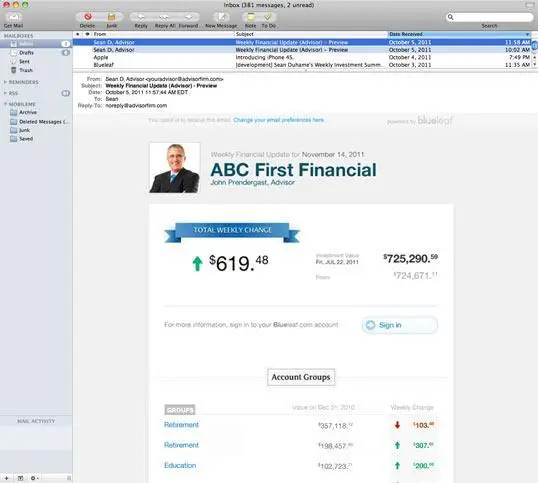

Frequently feeding the updated information back to clients reminds them of the value you deliver. All these touches can and should be advisor branded and should be delivered in multiple forms like weekly emails, live portal access and sometimes even static documents. This is the part of the process that associates you with their complete financial picture – the feedback portion of the loop.

The process of frequently gathering updated information also ensures a full picture for an advisor and allows you to be first to know about changes to a client’s situation. This early and complete knowledge creates a plethora of opportunities to deliver value added advice and services. You can beat competitors to the punch. This is the update portion of the loop.

Frequency is key, advisors who are all growing at over 100% per year all agree. When they talked about update and feedback often, they meant it. In our sample, all of our high growth advisors updated their information DAILY, yes daily. They also sent information to clients at least WEEKLY and many of them sent clients information multiple times every week.

For all of these advisors, aggressive use of automation technologies was the only feasible way to update and deliver information to their clients and prospects at scale. The core technology they relied on was account aggregation. They all embedded the process of encouraging clients to use it in every facet of their business; prospecting, client updates, marketing communications etc. These advisors also used almost all leveraged client portals, document vaults, email automation and most used CRM systems. When combined, these technologies and their processes created a powerful growth engine that converted prospects at much higher rates. Also, it gained share of wallet among existing clients, as well as generating regular referrals much better than other advisors.

This quote from Marc Heglund (a co founder at Wesabe) is useful. Wesabe was a competitor to Mint that launched 10 months earlier. He wrote a famous blog post with his take on why they lost to Mint.com. His advice is below.

“Focus on what really matters: making users happy with your product as quickly as you can, and helping them as much as you can after that. If you do those better than anyone else out there you’ll win.”

Switch out a few words and you get this for financial advisors.

Make clients happy with your service as quickly as you can, and then help them as much as you can after that. If you do this better than alternatives and you’ll win.

2. Making Your Prospects Happy Fast

It takes a lot of work to get a new prospect. Here’s how getting them organized leveraging the gather-feedback loop is the fastest way to deliver value and convert them into clients.

a. Explain your approach in an understandable way up front

Explain it from their perspective not yours. How does you gathering information about them, help them? How will the information you provide back to them improve their life even a little bit. If you’re using a completely automated system like Blueleaf, you can use something like the below email/call outline.

**************

The first step in figuring out if we’re a good fit to work together is for us to do an analysis of your situation and come back to you with our thoughts.

We have a way of doing that will save you lots of time and give you a unique view into how we work.

I’m going to send you an invitation to our CLIENT system. Yes, our actual client system. It means that you’ll be on the exact same system as our current clients. That will give you a feel for working with us before you agree to become a client. It’s a sort of try before you buy approach that allows you to get to know us better while we do our analysis.

This system will also automate the gathering of your financial information. Rather than gathering paper statements, it allows you to provide us the information electronically and automatically. It saves you time, and it will allow us to do our work and get back to you more quickly since the information will be automatically available to our analysis system.

If you become a client, this is the same system that will give you complete access to information about the money we’re managing and at the same time give you a complete picture of all of your money that is always up to date.

In fact, we can do this all right now and I can walk you through it in a few minutes.

**************

b. Create early positive associations with multiple branded touchpoints

Now that you’ve got their information, it’s time to begin feeding it back to them. You can do this in many ways even before any analysis or proposal is complete. Sending prospects a simple summary of their situation in an attractive format is a great option. By separating this from any proposal, you earn yourself a value added, branded touch.

With an automated system, like the ones our growth rock stars use, communications will happen automatically. Their systems sending a weekly email update that shows prospects their complete picture at a glance and begins associating your firm with their money in a way that wasn’t possible before. In addition, an automated system should be capable of sending alerts and will allow you to proactively reach out demonstrating how closely you’re able to monitor their information.

c. Include prospects in other communications

Make sure that you include prospects in other communications like blog posts, emails, letters and social. These communication should be consistent with the approach that you have outlined.

d. Use automation technology

Automate to dominate. Beating your competition is a lot of work. This is not an approach that is easy to do manually unless you’re growing slowly. However, if you begin to use this approach, our research is clear – your growth will accelerate. So automate as soon as you can or you may find yourself growing to fast to keep up. Automation technology that is client facing has another advantage, it demonstrates how easy it is to work with you and reduces friction to becoming a client.

e. Deliver real value in your first meeting

Having the complete financial picture means that you can ask better questions. Asking about assets can seem self serving. The focus of your first meeting can be on understanding goals and setting expectations rather than data gathering.

3. Why Does Helping Them Feel Financially Organized Work As a Growth Tool?

a. It delivers on a fundamental desire – simplifying life

The gather-feedback loop gives clients a powerful sense of control over their money. You being the conduit to that control confers on you and your firm the status of major life simplifier. That creates a key bond with clients. Doing that early in the prospecting process does this in a way that makes it a much more obvious decision to work with you. It also creates a switching cost in that they’ll lose this new found feeling of control over their money if they choose not to work with you.

b. You instantly reduce prospect’s worry

High growth advisors communicate a clear approach and strategy early. The gather-feedback loop lets the client easily see that strategy in action. Aggregation and other technologies automate and simplify it for prospects. Some advisors worry that frequent feedback will cause clients or prospects to worry more. The evidence from our high growth advisors is absolutely clear: it’s the opposite, it reduces worry.

Why, it’s what we call the CNBC effect. With a 24 hour news cycle, clients are already being worried by an alarming deluge of “news” designed to create anxiety in search of ratings. The fact is this information typically has little to do with clients’ financial reality but they can’t see that – they are blind to the fact that their net worth is barely affected. The frequent feedback loop counter acts the news cycle with the reality that they are better off than they would be led to believe. Over a short time, the feedback actually begins to desensitize most clients to the news cycle and allows them to, for the first time in many cases, focus on the future.

Delivering that experience to prospects is incredibly powerful and is a key reason for the high close rates cited by our high growth advisors.

c. You become easier to deal with than competitors

A prospect currently with another advisor will notice a dramatically better experience. Getting all the systems set up in minutes is a breath of fresh air. The paper intensive process of their current advisor makes them look bureaucratic and archaic. And if they’ve never worked with an advisor, you set a benchmark that’s hard to match.

d. Your transparency helps build trust early

Transparency means that any misunderstandings are identified early before small issues become big issues.

e. You get a simple, accurate and complete view of the client’s wealth

Can you really be an effective wealth manager without the full picture?

f. The client can “try before you buy”

Allowing prospects to participate in the same system as the current clients, allows them an unprecedented “try before you buy” experience. Closing rates skyrocket. Some of our superstar advisors literally have a 100% close rate in the past 12 months. The advisor also gets an opportunity to see if the client is a fit. It’s easy to remove a prospect from the system if the fit is not there. The prospect will expect to be removed from the system if the expectations are set properly. Offering access on a “trial basis” helps with this.

g. It increases referrals

The gather-feedback loop makes wealth management tangible. Communications, like system generated summary emails, show prospective clients what comprehensive wealth management looks like. Advisors tell us that their top referring clients simply show the prospect their weekly email to demonstrate how organized and simple their finances can be.

4. Summary

The high growth advisors that we talk to tell the same story. The gather-feedback loop applied at the very start of their discussions is key to their success. They show that they can take the worry away but helping clients “get organized” as their first step with prospects. These advisors make prospects excited about working with them early on. As a result, they do very well winning new clients especially when competing with advisors with weak technology.

Next Step?

Not growing as fast as you would like? Talk to us about how we can help you become a high growth advisor.

Also published on Medium.