Last Updated on July 20, 2020 by John Prendergast

Fiduciary responsibilities are integral to your work as a financial advisor.

It’s your job to not only act with a high fiduciary standard of care, but it’s also your job to communicate this with your clients.

Your clients, both current and prospective, have grown increasingly anxious about the state of their savings and investments. Most advisors feel overwhelmed by the complexity of the fiduciary standards and wonder how to maintain best practices as their business grows.

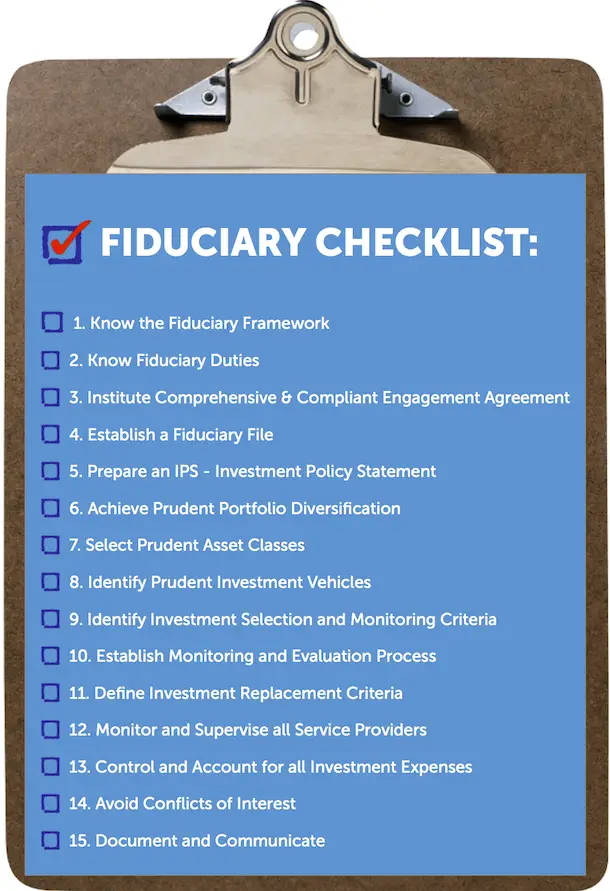

Below is a quick checklist of the 15 fiduciary best practices you need to know as a financial advisor. You can also get a full walk-through of how to tackle each step here.

15 things to focus on… easy, right?!

If you want a detailed explanation for each of the 15 steps (as well as free advice and guidance from a fiduciary expert) just grab this Fiduciary Guide.

Below is an example of what’s inside.

Excerpt from the Fiduciary Guide download:

#9. Identify Investment Selection and Monitoring Criteria

Consistent with the IPS, the advisor should apply a consistent and dependable investment selection and monitoring process.

A.) Apply Quantitative Analysis

• Identify a recognized benchmark index to be used over a full market cycle (e.g. a minimum of 5 years) and an appropriately defined peer group of investment managers, with superior 5 year standard deviation (volatility of returns)

• Identify consistency of investment approach and appropriateness of investments in light of investment objective and IPS constraints, including liquidity needs

• Verify fair and reasonable investment management expenses

B.) Apply Qualitative Analysis

• Verify stability and culture of the organization

• Determine that there are no pending or continuing regulatory issues or litigation that may affect investment performance

• Verify the timeliness, accuracy, and content of investment reports deemed to be necessary to evaluate the manager’s performance and responsiveness of the manager to requests for information from the client

• Look for superior portfolio construction and risk management discipline, where appropriate.

Blueleaf.com helps financial advisors automate transparent client engagement and reporting, effectively maintaining the highest level of your fiduciary standard of care. Curious? Take a video tour.