Last Updated on July 20, 2020 by Carolyn McRae

Pause.

Pause.

You’re comfortable right now, sitting down, reading the words on your screen. You have your clients, you’re helping them manage their assets and you have a plan for their future.

But in a few minutes you get an email. And suddenly your business is at risk.

There’s been an unexpected change in your client’s life and now their assets are under the control of their eldest son, Eric. Wait. That’s his name, right? Eric? Uh oh… time to make a few phone calls.

… You’re not prepared.

Waiting until your client’s assets are in motion to try and create a relationship with the family simply does not work.

In cases like the one above, you’ll be viewed as an ‘ambulance chasing ghoul’ rather than a trusted advisor. It won’t work for you and it is not in the best interest of your clients, either.

Your clients want to know that their families will be taken care of and you can’t do that unless you include them in important financial discussions and decisions throughout the relationship. This takes work upfront, and tomorrow’s too late to start.

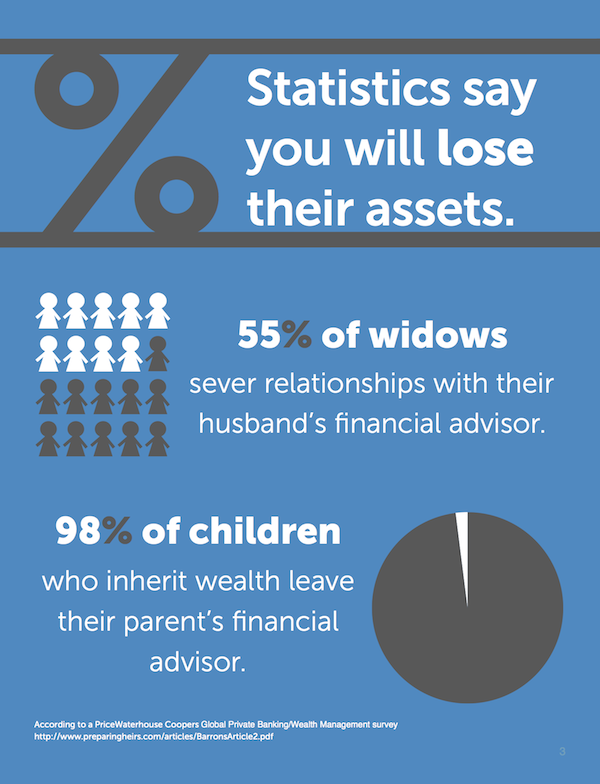

Plus, studies prove your business will suffer. The majority of advisors lose a client assets when “money is in motion”:

Unfortunately, losing ‘money in motion’ means that advisors are constantly working to replace lost AUM after transitions rather than continuing the relationship and managing the money as it transfers to other members of the family.

You CAN take charge.

You CAN control your fate and protect your business from becoming a statistic. You DO have the chance to keep clients’ assets under your management, even when “money’s in motion” between family members. Here’s how:

Step 1) Understand this is a real threat.

Step 2) Understand the timing is out of your control.

Step 3) Prepare.

You just need to prepare. To get step-by-step help, read Money In Motion, a free guide that covers simple, automated, cost effective and personalized approaches that you can use with any and ALL of your clients’ family members. And learn how to do it without burdening you or your staff. By the end, you’ll have the tools to deepen relationships with the family so that you can retain clients and AUM despite wealth transfers. You can download a copy here.