Last Updated on July 20, 2020 by Carolyn McRae

We all know saving for retirement is important. We’ve been taught this.

Our parents, grandparents, aunts, uncles, in-laws, friends, coworkers (and financial advisors) all chat about saving for retirement. We’ve seen the research… the charts and graphs that prove what a monthly contribution to our retirement savings account will look like in X years.

But it’s not fun.

Your clients are uninspired. Their rational brain knows their “retired self” will one day be grateful for each dollar saved, but they can’t see “retired self”. They see “now self” and “now self” sees saving money for “retired self” as a missed opportunity to spend, spend, spend on the life they’re enjoying today. Their “now self” is sees life happening all around them and they want cash to pay for that awesome life.

This is fine. You do need cash to spend now. But here’s the truth about how retirement plays into it, dear “now self”:

Life happens. You want to spend cash on life.

Time passes. You want to retire.

They’ve got the first part covered; living life and spending money on that life. They also know they want to retire. But the missing piece to the puzzle is seeing time.

Yes, a big reason our “now selves” begrudgingly save for retirement is we don’t easily relate to the passing of time.

We know retirement will happen, but it’s far in the future. “Now self” struggles to see something that will happen decades from now. Sure, when we see “retired self” approaching, we’ll eagerly put money away. Until then, putting money away feels like a chore.

As their advisor, you’ve probably discussed some version of this and the client probably nodded, smiling politely. But if you’re just talking about it, you’re not helping them see it.

Help Clients “See” Time.

You need to help clients see their “retired self” and make that future self feel real, today.

Time is hard to visualize, but it’s crucial you do it. Not only because visualizing time will help their “now self” see their “retired self” and appreciate the need to save, but also because visuals are a powerful education tool for the majority of people.

Approximately 65 percent of the population are visual learners. (Source)

Simply talking about retired lifestyle, and dollars, and years won’t resonate with visual learners. You need to show them their “retired self” is real and worth saving for.

How? Show them their life.

Show them how each small increment of time that passes actually adds up to big chunks of time, and before they know it, they’ll be nearing retirement.

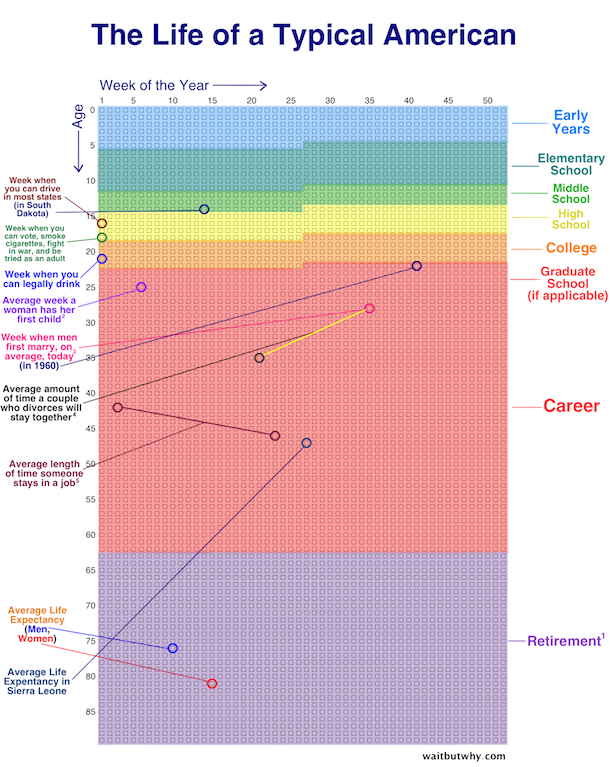

Below is a particularly powerful graphic that displays the life of a typical American in the form of small week blocks. I’ve also shared some ideas for how to leverage it in your discussions with clients.

Source: waitbutwhy

You can use this visual to:

Help clients see what happens during a typical life in regards to cash.

– Accept cash from parents during blue, blue-green, green, yellow and orange

– Earn cash during red

– Spend cash on yourself during orange and red

– Spend cash on your children during blue, blue-green, green, yellow and orange

– Save cash during red

– Spend cash on yourself during purple

Help clients see the importance of saving ‘enough’ during their red years.

– Cash earned during red will pay back debts from orange

– Cash earned during red will pay for living expenses (food, shelter, clothing) during red

– Cash earned during red will pay for short-term fun during red

– Cash earned during red will pay for your child(ren)’s blue, blue-green, green, yellow and orange

– Your savings during red need to pay for living expenses (food, shelter, clothing) during purple

– Your savings during red need to pay for short-term fun during purple

– etc.