Last Updated on July 20, 2020 by DJ

It’s hard out here for an advisor…

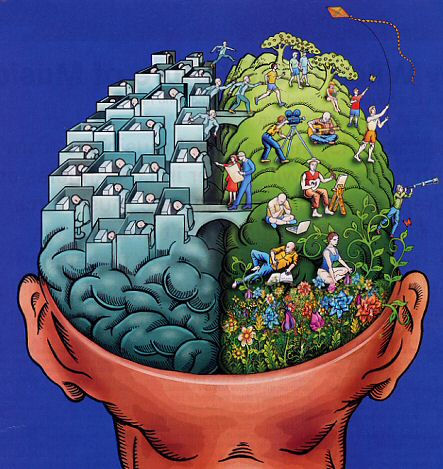

Perhaps the biggest contradiction inherent to financial advisors is that the job itself requires two very different skill sets:

People skills (for earning, engaging, learning about, and managing clients) and

Analytical skills (to make sound suggestions regarding a clients assets)

These skills are often siloed in other businesses (think sales versus IT), but in order to be a great advisor you must possess both faculties and be able to leverage each of them appropriately.

As if developing and honing each of these skills weren’t enough work, a new study shows that your brain is actually incapable of functioning analytically and empathically at the same time. Seriously:

Scientists have discovered that the brain circuits we engage when we think about social matters, such as considering other people’s views, or moral issues, inhibit the circuits that we use when we think about inanimate, analytical things, such as working on a physics problem or making sure the numbers add up when we balance our budget. And they say, the same happens the other way around: the analytic brain network inhibits the social network.

– Brain Can’t Empathize And Analyze At Same Time, Says New Study

Let’s assume that all of this is true, or, if you have a hard time believing, let’s imagine how a typical client interaction might play out if you did believe that the brain couldn’t think analytically and socially simultaneously.

Leave your assets in the office…

We’ve talked a bit about the old-standard free consultation before (and how they could be better), but this new study has me thinking that maybe client meetings in general (especially early relationship-developing ones) might go better if we left the numbers, the accounts, the assets–the drivel–at the office.

It’s pretty easy to understand why advisors might bring up tolerance percentages, held-away assets, 401ks, and the like during a client meeting–that is, in essence, the raw material that advisors work with. But my argument would be that when you’re sharing a coffee with your client, your job is to talk to your client (not analyze their assets right in front of them)! Yes, you are sitting with them with the goal of becoming or being a better wealth manager, but that starts with understanding your client as a person! How else will you get them to where they need to be financially?

A more practical suggestion:

Use the 80/20 rule and keep your conversations with clients 80% social, 20% analytical.