Last Updated on July 20, 2020 by DJ

We’re approaching a major shift in wealth management.

Consider the following, tweeted live from The Tiburon CEO Summit XXI:

1/2 of financial advisors plan to retire within the next 15 years, setting off a generational power shift to Gen X and Gen Y advisors #in

— Adam Verchinski (@EverydTenacity) November 18, 2011

That’s interesting but it doesn’t really affect you. Or does it? Well, it’s actually a number that implies as much about clients as it does about advisors. You see, this whole generation shift thing is happening to everybody.

EVERY YEAR your new clients will be younger

The average Baby Boomer will turn 57 in 2012. In just a few years, the vast majority of this generation will exit, or, at the very least, prepare to exit the workforce and enter retirement. These folks are near the top of their savings accumulation phase and are the most heavily targeted group on the planet.

On the other hand, the average Gen Xer will turn 40 in 2012, while the average Gen Yer will turn 25. These groups are in the middle of or just beginning to save for retirement and may have just joined the “mass-affluent.” While there are marketing dollars spent here, these people are relatively ignored by advisors.

NEWSFLASH: THE MAJORITY OF NEW CLIENTS THAT YOU EARN IN COMING YEARS WILL BE FROM THE X & Y GENERATIONAL COHORTS!

It’s a simple matter of numbers and relative marketing effectiveness. (But lets save that for another post.)

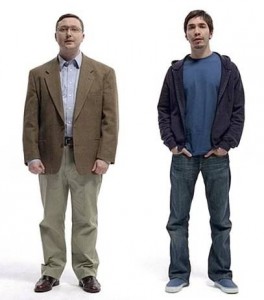

Meet Your New Clients

They’re savvy, more connected, more entitled and most likely have access to all of the same information that you do. So what does this mean? They need guidance not information. Interpretation not data. In short, their attitudes are quite different.

(Adapted from BusinessWeek’s A Boomers Guide to Communicating With Gen X and Gen Y )

TECHNOLOGY

Generation X: Keep it up-to-date and motivating. Music at work, BlackBerrys, IM, and fast computers are all part of the Gen X package.

Generation Y: Encourage suggestions and don’t fear change. Gen Y is more comfortable with technology than any other group. Learn from these clients and stay on the cutting edge.

COLLABORATION

Generation X: Limit in-person meetings. Offer alternatives like conference calls, video, and Web conferencing when collaboration is truly needed. Email is a staple. For face-to-face meetings, stick to short productive conversations and skip long planning sessions.

Generation Y: Gen Y started online social networks. Think about how you can leverage them to encourage collaboration and connection.

SOCIALIZING

Generation X: Invite but don’t push them to participate.

Generation Y: Appeal to their career goals. Gen Yers are more likely to attend a networking event that will expand their personal contacts.

So, how will your business need to evolve to serve these new clients?

Consider the following, a tweet from self-proclaimed financial planning nerd Michael Kitces:

Just saw President’s Cup snippet. I wonder: Is financial planner as caddy handing you the right financial tool a better analogy than QB?

— MichaelKitces (@MichaelKitces) November 19, 2011

This is an interesting question. There is no doubt that your younger clients will be more knowledgeable about investing, planning and the tools required/available. They will require different styles of engagement, and different acquisition strategies. But caddy versus quarterback?

You’re a co-pilot now

As a quarterback you’re in charge, you call the plays and the team executes. That image has never really been true of the advisor-client relationship. As a caddy, you’ve done the schlep-work and are recommending clubs but you’re along for the ride and a $5 tip. Not true either and not exactly a position to aspire to. As a co-pilot, or more precisely as a navigator, you are working with another professional who is equally skilled and qualified but you’ve got different roles in achieving the same objective. Equals, professional colleagues, now we’re in the ballpark.

Different interaction, different relationship, but what does it all mean?

You’re No Longer In Charge of Information Flow

They might hear about that new financial website before you do and even invite you to join them. They’ll hear on CNBC about the European debt crisis and understand they don’t have direct exposure but can’t assess how it might affect them. The point is, they’re going to be better at receiving information than processing it, especially outside of their field.

That’s where you come in. Listen to them and respond quickly. Work with them as a colleague. Encourage them to share their opinions, and always keep an open mind. Join the websites they send to you and shoot them a Tweet with one you think they might like. Explore the new technology they told you about, and let them know why you’ve decided to use or not use it. From day one, they’ve been told that they can do or be anything, don’t get in their way.

How will you help them?