Last Updated on September 18, 2020 by Carlo Navarro

We got a call from one of our customers early last week. Feedback from our users – whether it is positive or negative – is vital to help us make Blueleaf better. This feedback was decidedly negative.

Here’s how the call went.

***************

Customer:

Hey, I got a lot of angry calls from clients because of Blueleaf and we want to cancel.

Us:

Sorry to hear about that. Let’s dig in and find out what went wrong.

Customer:

Your system panicked our clients and they were really upset about the market. They all talked about going to another advisor as a result.

Us:

Well, that’s not typical, mind if we take a look? Let’s look at one of the clients.

Customer:

“Client name 1” was one that called.

Us:

Thanks. Can we look at another?

Customer:

“Client name 2”.

Us:

Let’s try another.

Customer:

Client name 3″.

Us:

Did any of your other clients call upset?

Customer:

No.

Us:

It looks like none of these upset clients were using Blueleaf but all of your other clients (who didn’t call) are on the system.

Customer:

Oh……

***************

So we got an angry customer call because of calls from clients that weren’t using Blueleaf.

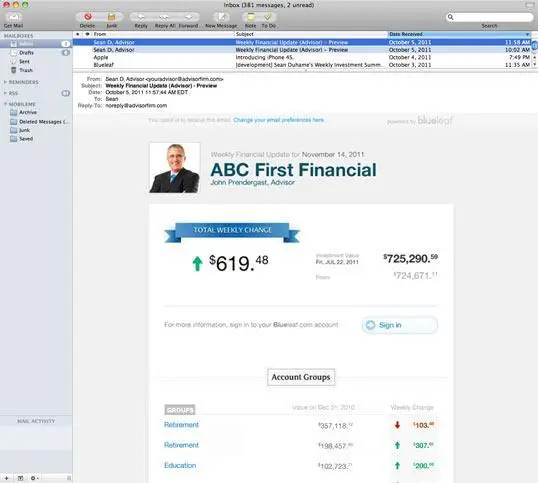

This discussion highlights that we need to do a better job of helping advisors track who’s using Blueleaf and who isn’t. We also need to help them bring more of their clients and prospects on to the system. There’s a lot of good reasons to do that. A big one is that by every behavioral measure that we have in the system, the clients receiving the weekly email saw the market correction as a non-event.

Why is this?

– Openness and transparency wins

CNBC and other financial news outlets are built to make clients nervous so they watch. Regular communications that put client portfolios in the context of their net worth means that the client becomes used to seeing how much less their net worth fluctuates compared to the market. They become accustomed to thinking of their portfolio in that context and volatility becomes less concerning. Seeing a few weeks (or even months) of down numbers is easier to take after years of positive emails. Advice to not even look at a statement and wait for their retirement “surprise” in 30 years is ridiculous. In psychology, people who are overly sensitive to something inappropriate but who are otherwise healthy are often taken through desensitization therapy. Blueleaf is essentially doing that for your clients.

– Better client communications

As clients go through this process, they ultimately focus their conversations on their goals. Advisors can then focus on communicating a clear, understandable investment philosophy and strategy with a specific financial plan built around their unique circumstances. Adjustments will be made but made based on a long-term plan, not with expensive, knee-jerk reactions to short-term market volatility.

Check out a blog post you may find valuable:

Communicating Your Value to Clients in a Down Market

So what happens when an advisor gets this right?

Check out this email from fast growing Blueleaf advisor Greg Brown from Michigan.

***************

Hi John, Phil,

The weekly email feature passed a stress test. I was really nervous about the big market correction we had last week, and how the weekly email would affect clients. There were big losses, that was a fact. I read all the emails. I thought my phone might be ringing off the hook, or worse, panicking clients demanding emergency meetings that go something like this: “I can’t take it… We need to reduce the risk of my portfolio NOW!”

I didn’t get a single call or email. Not a one.

I still get advisors telling me I’m nuts doing this weekly email. It’s counterintuitive, but it appears to work!

***************

Blueleaf has gone out on a limb to deliver what advisors really need, even though it flies in the face of conventional wisdom (which often has little real wisdom). We’ve built the Blueleaf platform based on the principles of simplicity, openness, and transparency. Financial advisors don’t really have a choice but to embrace these principles. DYI investment solutions from Robo-advisors are growing fast making the old model of “trust me – I’ve got this” look expensive and out-of-date.

The real value that financial advisors offer today is in helping their clients make the right financial choices. Choices based on strategies that are built on data, not emotion. Advice needs to be delivered with crystal clear communications, proactive management toward long-term goals and simple support systems. Our data shows that advisors that have embraced this new world are winning in the market, winning with clients and creating scaleable, high-value businesses.