Last Updated on July 20, 2020 by Phil Rogers

“What are you doing to grow so fast?”

Our Customer Success team always ask high growth advisors this question when we see outsized growth results.

A vital part of the Blueleaf service is coaching on how to get the most from the platform. This conversation often spills over into other growth strategies and tactics. We then share this learning through direct coaching calls.

Our Customer Success team thought that it would be useful to pull some of these strategies together in one post.

So, here they are.

The top 4 ways that the fastest growing Blueleaf advisors stay ahead of the pack.

1. Deeper client understanding

Advisors have a good understanding of their clients’ needs. Unfortunately, day-to-day client management does not often provide opportunities to dig a little deeper.

Over time, advisors can mistake their own beliefs about what problems their clients have with the client’s actual problems.

Advisors are not alone in doing this.

A study by Edelman Insights found that only 10% of consumers felt that brands did a good job about asking their needs.

Doing some structured qualitative research can help build a deeper understanding. This research can help you build a better picture of your ideal client. The interview process is pretty straightforward. However, it can be a bit awkward the first time.

Step 1: Choose an ideal client

The test here is pretty simple. Who loves working with you and who do you like working with.

Step 2: Ask the right questions

You want to get a sense of a day in the client’s life. What are their top financial concerns? Interviews should take 20-30 minutes.

Step 3: Document

An interview process with structured, open questions will allow you to gain new insight.

Make sure that you document the language that the ideal clients use. You want to describe their problems and your solutions in your marketing materials using their language whenever you can. This will help build up a model of your ideal client and help you build marketing assets that will resonate with prospects like them.

You should try and complete this process with at least 3 ideal clients.

2. Explaining your value in a compelling way

Your qualitative ideal client research will allow you to explain the value that you offer in a much more compelling way. High growth advisors take this kind of research and create value propositions that help prospects take the next step.

Most advisors lack the 60-second elevator pitch that explains:

- how they solve client problems or improve their situation (relevancy)

- the specific benefits they deliver (quantified value)

- why the ideal client should buy from them and not from the competition (unique differentiation)

Clarity of value proposition is the #1 factor that drives prospect connections and client referrals.

A well-defined value proposition makes it easy to answer the question – what do you do and how you are different.

Alliance Wealth Management Example

Blueleaf Advisor Jeff Rose markets his services through a number of sites. We’ll focus in on his advisory firm – Alliance Wealth Management.

The site messaging focuses on people close to retirement with an emphasis on retirement income.

Header: How secure is your nest egg? (Video title)

Subheader: We help create clearly defined retirement income strategies for people in or nearing retirement so they can have confidence that their retirement income will last as long as they do!

Feature 1: Custom fit solutions

Feature 2: Personal services

Feature 3: Unique financial approach

Analysis

Alliance Wealth Management questions the reader about their financial security. Financial security is top investor concern.

The sub-header answers this question by offering to deliver confidence that their retirement income will last with unique retirement income strategies .

This positioning is supported by 3 features.

Clients get:

- A better retirement because the solution will be “custom built” based on their goals

- Time savings suggested by “personal services” or that the firm is going to do the work for them

- Better returns implied by the “unique financial approach”

Is this positioning differentiated?

Alliance Wealth Management is focused on clients worried about their retirement savings lasting. Their differentiation is built on unique expertise in retirement income strategies and focus.

3. Delivering value fast to prospects

Our customer success team uncovered this consistent pattern with high growth advisors. High growth advisors gather tons of client information and feed a value-added version back to their clients. Frequently.

This gather and feedback loop always begins for these top performers before their first meeting.

They explain the need to gather the prospects’ account information simply. Something like “I need you to add your accounts so we can have a productive first meeting. It will just take a few minutes.”

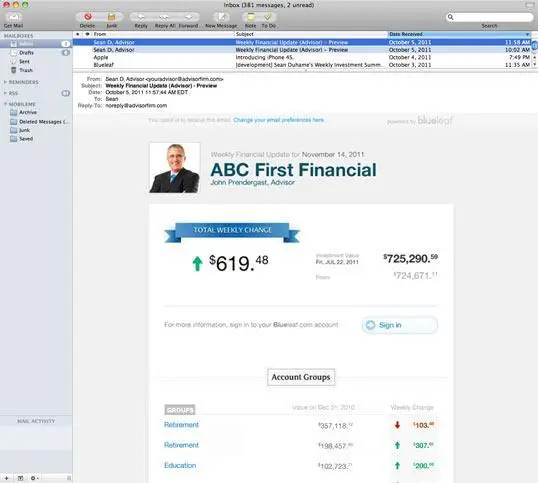

The information can be fed back in useful ways even before any analysis or proposal is complete. Sending prospects a simple summary of their financial situation in an attractive format is a great option. By separating this from any proposal, you earn yourself a value-added, branded touch.

With an automated system, like the ones our growth rock stars use, communications just happen. One-to-one emails are sent. No effort required.

They also include prospects in other communications like blog posts, emails, letters and social.

The first meeting now has a completely different dynamic. Having the complete financial picture means that you can ask better questions. The focus of your first meeting can be on understanding goals and setting expectations rather than data gathering.

4. Building an always on / value add position with clients

Many advisors believe that their clients are busy so they restrict communications to annual reviews and quarterly reports.

The reality is that clients want proactive service and simple communications that show their progress. Highly satisfied clients refer more prospects.

a. Communication frequency

A recent Morningstar survey found that 30.4% of clients prefer weekly emails from their advisor, 36.6% prefer them monthly, only 19.9% prefer emails quarterly, and a mere 9.4% prefer them annually. The research is clear. Clients want to be emailed, and often.

Blueleaf’s own behavioral data shows that over 60% of clients will open and read a relevant weekly email about their situation and almost 90% will open that same email once per month. In fact, we’ve found that advisors who are the most successful in growing their business will email their clients even more than once per week.

We spoke with Jason Wenk, Founder and President of Retirement Wealth Strategies. His firm is an early Blueleaf user growing at 50% per year. He reported reaching out to clients at least 150-200 times per year. This translates into a minimum of 12.5 contacts with each client per month, 4 of which are handled automatically with his weekly Blueleaf email, we know he’s on to something.

Another Blueleaf advisor, Katie Stokes found that increased communication meant more two-way communication.

b. Client-focused reporting

Frequent snapshot type communication is only part of the story. The more detailed reporting needs to be understandable also.

Unfortunately, many advisors choose to deliver time-weighted performance reporting. Time-weighted reporting can be confusing for the client. It shows how their advisor is performing relative to benchmarks. A client wants to see how they are progressing towards their goals. The performance of their advisor is interesting, but their personal progress against their goals is their priority. An advisor creates value for the client by helping them understand their individual performance with simple, always available reporting.

c. Proactive management

Fast growing advisors also are clear that they need to know about all the client’s assets and liabilities. The reasoning is simple. They need to know the full picture to get the best results. Examples can be useful. Would you have an operation without a full review of your overall health?

One Blueleaf advisor asked his clients to add all their accounts. Most of them did. As a result, his clients gained comprehensive advisory help rather than just the management of one or two investments. The Blueleaf advisor grew his AUM from $11M to $24M in 12 months.

5. Summary

A deep client understanding, clarity about what is unique about the way they solve the client’s top problems and a focus on continuous value delivery are the characteristics of high growth advisors.

A small amount of time invested in qualitative client research can make a big impact.

The test is simple. Does everything you do help solve a key client problem? If it doesn’t, stop doing it.

The result of this process can be transformative.

Better client relationships faster. More referrals.

Not a user of Blueleaf?

Sign up for a trial and test the platform with a couple of clients. See how your client’s face lights up when they realize they can see everything in one place. Receive their praise when they start getting their weekly emails. You might get some interesting news about client assets that you didn’t know about.

For your free trial of Blueleaf, sign up here.

Have some thoughts, comments or questions? Add them below.